Debit Spread Vs Credit Spread

Feb 25, 2020 · a debit spread is named as such since the trading account’s balance is reduced as the total value of the options bought is debit spread vs credit spread higher than the premium earned on the options sold. on the other hand, a credit spread generates a money inflow since the premium collected from the options sold is higher than the cost of the options bought. Nov 07, 2009 · now let’s consider debit spreads on the opposite end of the spectrum. these are called debit spreads because your broker is actually going to debit your account for the net premium, as opposed to giving you credit. the most you lose with the debit spread is the premium net. gains are limited and this option does not require a margin.

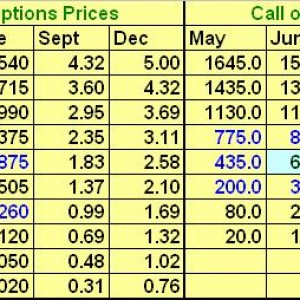

Jan 15, 2018 · at the same strikes, a call debit spread should behave similar to a put credit spread. whether the iv is low or high, the premium you pay with a debit spread is the same as the max risk in a credit spread ie. collateral minus the credit received. the max risk is the same, max profit is the same, break even point is the same. Credit cards allow for a greater degree of financial flexibility than debit cards, and can be a useful tool to build your credit history. there are even certain situations where a credit card is essential, like many car rental businesses an. Debit and credit notes are common terms in modern-day banking. if you have a background in accounting or finance, you will recognize that bookkeepers also use these terms when recording corporate transactions. when applied correctly, debits. A debit spread is named as such since the trading account’s balance is reduced as the total value of the options bought is higher than the premium earned on the options sold. on the other hand, a credit spread generates a money inflow since the premium collected from the options sold is higher than the cost of the options bought.

Credit Spread Vs Debit Spread Whats The Difference

I've written quite a bit about credit cards, but i know that many people shun them entirely, in favor of using their bankcards when making transactions with plastic. their argument's a valid one; because a bankcard is linked directly to a c. Debit cards are used to purchase more than $1 trillion of goods and services every year: good news for banks, but not necessarily good news for consumers. looking for the perfect credit card? narrow your search with cardmatch™ looking for t. In the end though, there is no theoretical difference between a credit spread and a debit spread at the same strikes of the same expiration period.

Credit spreads are less directional in nature than debit spreads. however, you can set up a credit spread to be bullish or bearish. but with a credit spread, you still have the potential to make money even if the stock stays the same or goes lower. Dapatkan profit konsisten setiap minggu dari forex trading. gunakan wiraforex expert advisor sekarang juga. Whether you are looking to apply for a new credit card or are just starting out, there are a few things to know beforehand. here we will look at what exactly a credit card is, what the benefits and detriments to having one are, what first-t. Both credit and debit spread had four commissions two for entry and two for exits. in some cases, the credit spread might not have the exiting commissions, debit spread vs credit spread yet in this case i have selected the trades of the same number of commission on the very same underlying. in short, when zooming in on the specifics there is very little difference between the credit and debit spreads. in both cases i.

Credit Spread Vs Debit Spread Better Option Strategy With

Sep 25, 2020 · generally speaking, debit spreads tend to be more directional, whereas credit spreads are more about collecting premium. but bottom line, all else being equal, it’s important to align the trade with the level and direction of implied volatility. Sep 28, 2020 · credit spreads, or net credit spreads, are spread strategies that involve net receipts of premiums, whereas debit spreads involve net payments of premiums. Generally speaking, debit spreads tend to be more directional, whereas credit spreads are more about collecting premium. but bottom line, all else being equal, it’s important to align the trade with the level and direction of implied volatility. keep in mind that multiple-leg option strategies can entail additional transaction costs, including multiple contract fees, which may impact any. Now let’s consider debit spreads on the opposite end of the spectrum. these are called debit spreads because your broker is actually going to debit your account for the net premium, as opposed to giving you credit. the most you lose debit spread vs credit spread with the debit spread is the premium net. gains are limited and this option does not require a margin.

Credit Spread Or Debit Spread Which Options Trading Strategy

Jan 06, 2020 · a premium below the threshold might be a candidate for a debit spread, and anything above it might be a candidate for a credit spread some choices are easy, like the way you put your jeans on. not only are you most likely to go with the fly-in-the-front, one-leg-at-a-time method, but it’s also the obvious choice. Whether you're interested in quick fixes or are looking for long-term solutions, working to improve your credit is a good idea. here are some tips to get you started. Debit cards link to bank accounts. the difference with using a debit card, though, is that the money you spend with a debit card is yours. you aren't borrowing money for the charges you make. learn all about debit cards to know if they are. Credit spread vs debit spread are the strategies used in options; it is a defined-risk strategy that lets you make bullish or bearish speculative trades. investors looking to make the best returns in today’s market can opt for a better trade options strategy. let’s understand which is the better strategy credit spread or debit spread.

Credit Spread Or Debit Spread Which Options Trading Strategy

Debit spreads and credit spreads are trading strategies that involves buying and selling options with a different strike price but the same expiration date. a debit spread is named as such since the trading account’s balance is reduced as the total value of the options bought is higher than the premium earned on the options sold. Credit and debit spreads are two fantastic options trading strategies. the credit and debit spread is a great way to reduce your risk while trading the stock market. credit spreads are a selling strategy that is less directional based than debit spreads whereas you could make money if the stock trades sideways. debit spreads are a directional based strategy that needs to move in a direction in. With a credit spread the maximum profit you can make is the credit you received when opening the spread and the maximum loss occurs when both options are in the money. << But according to some statistics,around 88% of options expires worthless. therefore,for practical reason,debit call and put spreadseven though they have advantages,still a hard game to play,unless we have at least 80% chance that the underlying security will go up or down to a certain range. credit spread,on the other hand,may be “safer”,if we are 80% sure of strong support and resistance. Getting a credit card is a fairly straightforward process that requires you to submit an application for a card and receive an approval or denial. the result of an application is mostly based on your credit score, although other factors are. Each method has pros and cons. your best bet is to stay flexible. ra3rn money has a long and diverse history. several millennia ago, cattle and other livestock served as currency. later, cowrie shells—from mollusks found in the indian and p.Credit spread vs. debit spread: what's the difference?.

Whether or not credit cards are worth getting.

Komentar

Posting Komentar