Credit Note Or Invoice

A credit note, also known as a credit memo (or memorandum) is a commercial document that the seller issues to the buyer. instead of the document being a request for payment (as with an invoice), the credit note is actually a credit for the buyer for future purchases. If you're planning to start a business, you may find that you're going to need to learn to write an invoice. for example, maybe you provide lawn maintenance or pool cleaning services to a customer. once you've completed the job, you'll need. Debit and credit notes are common terms in modern-day banking. if you have a background in accounting or finance, you will recognize that bookkeepers also use these terms when recording corporate transactions. when applied correctly, debits. A credit note or credit memo, on the other hand, is a document you attach to invoices. these are typically used when a customer returns items to the vendor. as the vendor, you create a credit note and attach it to the original invoice to nullify it or to subtract the items returned. or if you accidentally send duplicate items or the wrong items.

Many Results

Dec 22, 2018 · a credit note or credit memo, on the other hand, is a document you attach to invoices. these are typically used when a customer returns items to the vendor. as the vendor, you create a credit note and attach it to the original invoice to nullify it or to subtract the items returned. A credit invoice or credit note is a statement detailing a refund or credit to an invoice. for example, you may issue a credit invoice if a customer asks for a refund or if you decide to give a customer a credit for any reason. in many cases, using credit invoices is more accurate than simply deleting an invoice from your records. Invoices credit note or invoice help you to keep track of what you have sold, who has purchased it and how much your customers owe you. an invoice is a communication tool that tells your customers what you've provided for them, how much it costs and how they shou. Whether you are looking to apply for a new credit card or are just starting out, there are a few things to know beforehand. here we will look at what exactly a credit card is, what the benefits and detriments to having one are, what first-t.

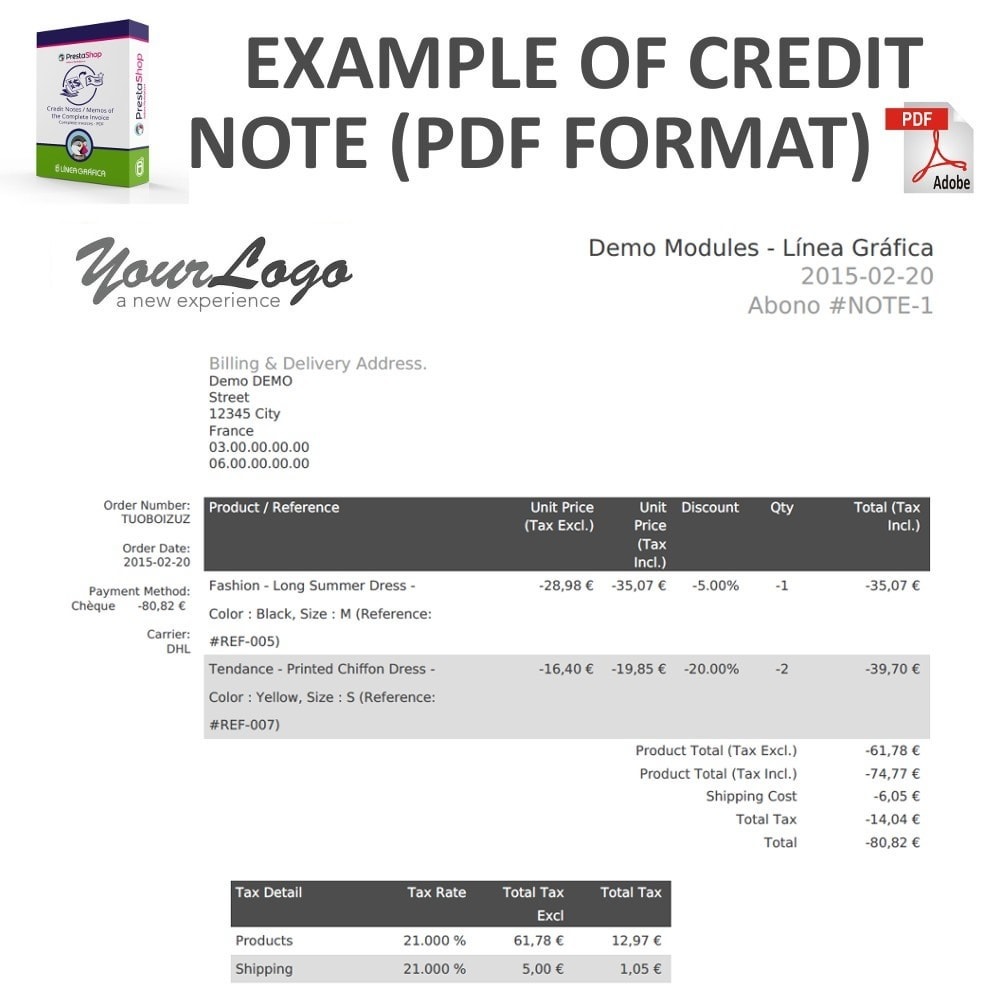

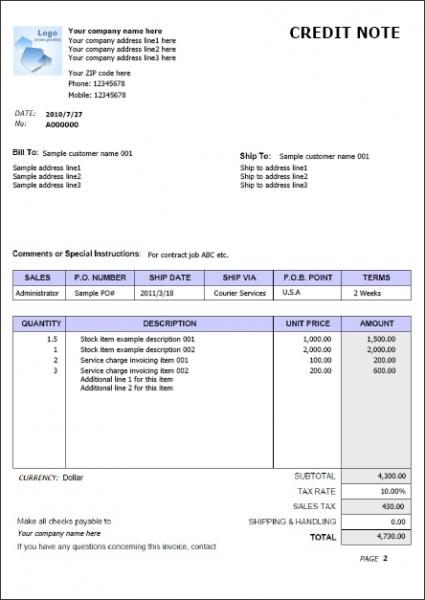

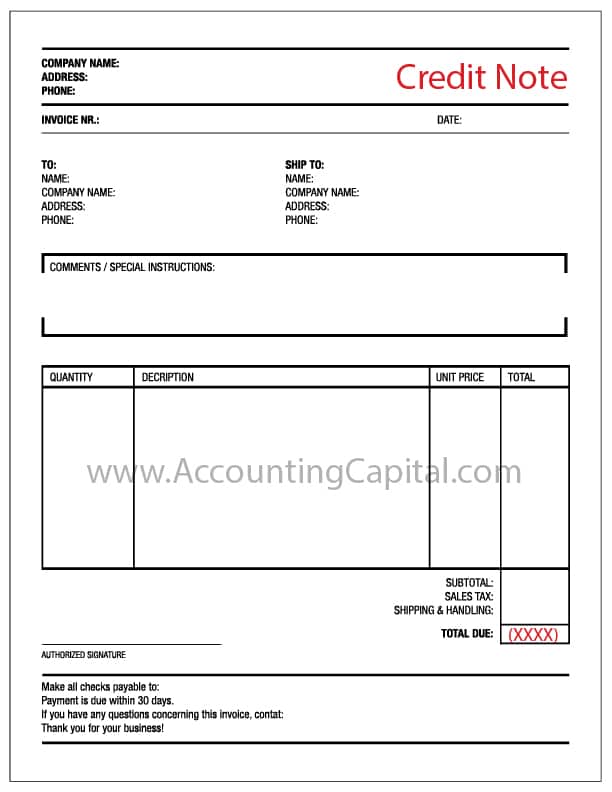

The credit note that you issue to cancel this should also be for £100. once you have issued your credit note to your customer, the incorrect invoice should be marked as paid and this will balance the amounts in your accounting. when you create a credit note, it will also have its own unique number, just like an invoice number. it’s important. Here are some of the things that should be included in a credit memo: start with the heading. write down, ‘ credit note’ ‘ credit invoice’ or the standard ‘ credit memo. ’ mention the value that will be reduced from the invoice versus credit note invoice. the credit invoice must be issued within. May 26, 2020 · the credit note normally references the original invoice and states the reason for the credit note. the credit can be provided to the customer as money or it can be applied to future purchases. generally, vendors opt to apply it to future purchases rather than providing a cash refund. for admin and recording purposes for both parties, it’s best to also include the following: the date the credit note is issued; the credit note number (this can be linked to the invoice number). like the.

What Is A Debit Credit Note Bizfluent

A credit note is a letter sent by the supplier to the customer notifying the customer that he or she has been credited a certain amount due to an error in the original invoice or other reasons. a credit note is also known as a credit memo, which is short for "credit memorandum. " this is a commercial document that the supplier produces for the customer to notify the customer that a credit is being applied to the customer for various reasons. the reasons normally include the following:. There was a mistake in the price on the original invoice; the customer overpaid the original invoice on the credit note, the supplier will list the products, quantities and product or service prices that were agreed-upon by both parties. it will normally reference the original invoice and state the reason for the credit note. the credit can be.

Definition Of Credit Note Accounting Terms Invoiceberry

In the united states, a credit report plays a large role in the financial decisions an individual will be able to make in the future. here is an overview that looks at what exactly a credit report is, who the three major companies are that. A credit note, also known as a credit memo (or memorandum) is a commercial document that the seller issues to the buyer. instead of the document being a request for payment (as with an invoice), the credit note is actually a credit for the buyer for future purchases. the credit note would be issued for the same amount or a lower amount of the. Search easy invoice software. get results from 6 engines at once. Your credit score impacts your ability to get car loans, secure a mortgage and more. keep reading to learn about the various ways to check your credit.

Credit Memo Vs Invoice Comparison Guide Reliabills

Credit notes that also include vat have a clear set of requirements for what should be clearly stated. essentially, a vat credit note should reflect the details of the vat invoice specifically, why it is being issued, the total amount to be credited and the amount before vat as well as the invoice number of the original invoice and the date. A credit note or credit memo, on the other hand, is a document you attach to invoices. these are typically used when a customer returns items to the vendor. as the vendor, you create a credit note and attach it to the original invoice to nullify it or to subtract the items returned. Getting a credit card is a fairly straightforward process that requires you to submit an application for a card and receive an approval or denial. the result of an application is mostly based on your credit score, although other factors are. May 05, 2017 · a credit memo is a contraction of the term "credit memorandum," which is a document issued by the seller of goods or services to the buyer, reducing the amount that the buyer owes to the seller under the terms of an earlier invoice. the credit note or invoice credit memo usually includes details of exactly why the amount stated on the memo has been issued, which can be used later to aggregate information about credit memos to determine why the seller is issuing them.

Whether Or Not Credit Cards Are Worth Getting

What is a credit note? a credit note is a document issued to cancel all or part of an invoice. in other words, it is a negative invoice. it is also called a credit memo. there are many reasons for issuing a credit note, including, the return of goods, invoiced the wrong customer, a different amount or customer not happy with the products or.

Basically, an invoice tells you how much a buyer owes a seller. a credit note tells you how much the seller owes the buyer. credit notes will also usually contain other information, such as contact details, the exact list of products or services refunded, and the like. in practice, a credit note looks similar to an invoice. As well as creating a credit note from an invoice, you can also create a credit note from scratch. 1. view your invoices. navigate to the 'work' tab and select 'invoicing' from the drop-down menu. 2. open the relevant invoice. click on the reference of the invoice. 3. open the ‘actions’ drop-down menu. then select 'create new credit note. Whether you're interested in quick fixes or are looking for long-term solutions, working to improve your credit is a good idea. here are some tips to get you started. Get invoice blank form. find millions of results here.

Credit cards allow for a greater degree of financial flexibility than debit cards, and can be a useful tool to build your credit history. there are even certain situations where a credit card is essential, like many car rental businesses an. Info about invoice and billing software on seekweb. the fastest search engine!. The credit note normally references the original invoice credit note or invoice and states the reason for the credit note. the credit can be provided to the customer as money or it can be applied to future purchases. generally, vendors opt to apply it to future purchases rather than providing a cash refund. for admin and recording purposes for both parties, it’s best to also include the following: the date the credit note is issued; the credit note number (this can be linked to the invoice number). like the.

Komentar

Posting Komentar